The Capital Infra Trust IPO is making waves in the Indian market as it opens for subscription from January 7 to January 9, 2025. This blog provides a detailed overview of the IPO, its highlights, and essential FAQs for investors looking to make an informed decision.

About Capital Infra Trust IPO

- IPO Size: ₹1,578 crore

- Price Band: ₹99 – ₹100 per unit

- Lot Size: 150 units (Minimum investment: ₹15,000)

- Issue Type: Fresh issue (₹1,077 crore) + Offer for Sale (₹501 crore)

- Purpose: To provide loans to project SPVs for repaying outstanding loans and strengthening financials.

Why Invest in Capital Infra Trust IPO?

- Strong Portfolio: Operates 26 road projects across 19 Indian states, including 11 completed projects and 15 under construction.

- High Creditworthiness: Rated ‘AAA/Stable’ by CRISIL.

- Steady Financial Performance: Reported a net profit of ₹115.43 crore for the half-year ended September 30, 2024.

- Long-Term Potential: Ideal for portfolio diversification and stable returns.

Important Dates

- IPO Open Date: January 7, 2025

- IPO Close Date: January 9, 2025

- Allotment Date: January 12, 2025

- Listing Date: January 14, 2025 (BSE and NSE)

Click Here to check Allotment Status

How to Find IPO Allotment Status on BSE, NSE, Link Intime and KFintech

FAQs

1. What is Capital Infra Trust?

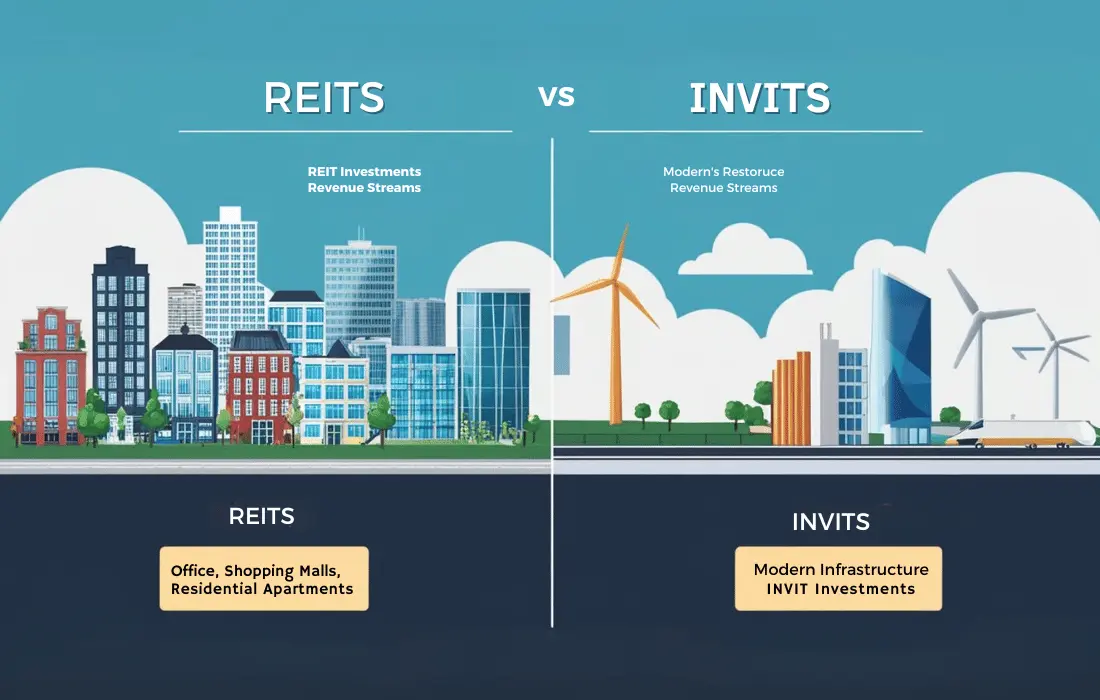

Capital Infra Trust is an infrastructure investment trust focused on road and highway projects in India. It manages projects under the Hybrid Annuity Model (HAM) in collaboration with NHAI.

2. What is the price band for the IPO?

The price band is set between ₹99 and ₹100 per unit.

3. What is the minimum investment required?

Investors need to bid for a minimum of 150 units, requiring an investment of ₹15,000.

4. How will the funds raised be used?

The funds will be used to provide loans to project SPVs for repaying outstanding and unsecured loans, thereby strengthening the financial structure of the trust.

5. What are the risks involved?

While the trust has high creditworthiness and a stable portfolio, risks include construction delays, regulatory changes, and dependence on NHAI payments.

6. When will the units be listed?

The units are expected to be listed on the BSE and NSE on January 14, 2025.

7. Who should invest in this IPO?

This IPO is ideal for investors seeking long-term stable returns and portfolio diversification through infrastructure assets.

Conclusion

The Capital Infra Trust IPO offers a promising investment opportunity in India’s infrastructure sector. With a strong portfolio, high credit rating, and stable financials, it caters to investors looking for reliable, long-term returns. However, potential investors should assess their risk appetite before committing funds.

Stay tuned for more updates and insights!

Disclaimer: This blog is for informational purposes only and does not constitute financial advice. Please consult with a financial advisor before making investment decisions.*